‘Put Life cover on expenses’

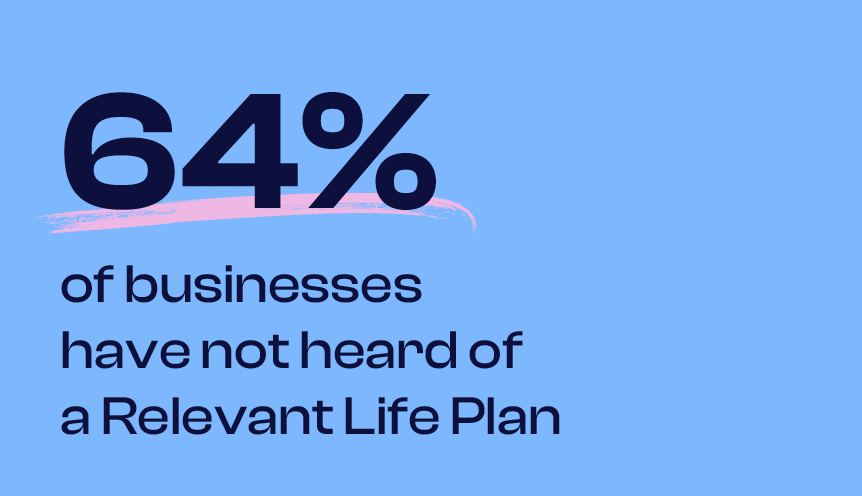

Relevant Life Plan offers a tax efficient way for an employer to arrange life cover, with a non-taxable benefit paid out to the employees’ family or financial dependents.

The cost of the plan is normally an allowable expense for the business meaning the business gets tax relief on the premiums paid.

With Corporation tax relief available, no additional income tax or National insurance to pay, it’s good for business for both you and your employees.

What is the relevant life plan?

It’s designed to provide life cover for an employee while working for you. This may include directors. Your business pays a regular premium based on the level of cover. If the employee covered dies or is diagnosed with a terminal illness (with a life expectancy of less than 12 months) whilst in employment during the term, the plan pay a fixed, one-off lump sum.

* https://www.sjp.co.uk/news/could-you-get-by-without-business-insurance- 03/02/2023

Relevant Life Plans can be particularly beneficial for small businesses that don’t have enough eligible employees to warrant a group life scheme. They can also be attractive for high-earning employees or directors who have substantial pension funds and don’t want their benefits to form part of their lifetime allowance, and for members of group life schemes who want to top up their benefits.